Paul Brodsky & Lee Quaintance run QB Partners, a private macro-oriented investment fund based in New York.

We advanced our macroeconomic analysis last month to a level we feel confirms the future course of US monetary policy and the consequent likelihood of a highly inflationary outcome.

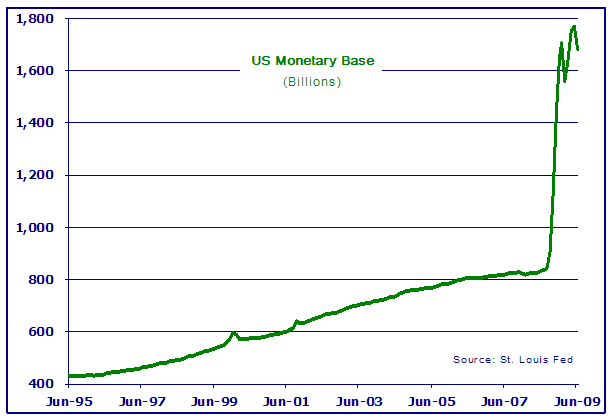

First, we tweaked the calculation of our Shadow Gold Price (SGP) from Federal Reserve Bank Liabilities divided by official gold holdings to Monetary Base (MB) divided by official gold holdings. (FRB Liabilities are bank assets while Monetary Base, plotted in the graph below, is a truer accounting of money - currency in circulation plus bank reserves held at the Fed.) The switch recognizes that borrowed reserves from the Fed included in FRB Liabilities are self-extinguishing, unlike additions to high-powered MB, which tend to remain permanent throughout all economic environments (and which may be further levered by the banking and shadow banking systems).

The change in our calculation produced a change in value of our Shadow Gold Price, yet we believe this new calculation is more robust and intellectually honest. As you can see from the graph below, the time series for the SGP mirrors the time series of the Monetary Base in the previous graph because the other variable in the equation (official gold holdings) has remained constant.

As the SGP implies, an ounce of gold would fetch almost $6,000 if we lived in a world characterized by disciplined money issuance. In effect, people and governments around the world would have been exchanging their Federal Reserve Notes for gold to the point that it would take 6000 bills to buy an ounce. The Shadow Gold Price solves for the price of an ounce of gold if the US dollar were still pegged to gold and its rise reflects the inflation of the Monetary Base. (Gold used to actually be the US Monetary Base prior to 1971, when the US and other governments abandoned the Bretton Woods Agreement that imposed monetary discipline on their money printing.)

Obviously this appears to be a crazy gold price within the context of the $900-plus price at which gold has been trading recently on global exchanges (though we do remember its rapid move from $35 to $880 the last time around). We are under no illusions that the price of Comex gold will rise to track what we see as its intrinsic value (not because it shouldn’t, but because we expect external market forces with great interests in protecting the sovereignty of fiat currencies to step in before that occurs, see “Potential Endgame – A Managed USD Devaluation” below).

Nevertheless, the SGP provides us with a baseline for inflation and absolute currency values. We also think the SGP is relevant because quantifying the magnitude of past purchasing power diminution provides us a framework for the relative scarcity of real capital assets versus financial assets and provides an intrinsic value target under which any market price for gold seems terribly cheap.

Manifestations

So far we have discussed past Monetary Base inflation and our attendant Shadow Gold Price, which indicates a wide disparity with gold’s public current market value. Consequently, we expect substantial increases in the prices of goods, services and certain investment assets. So why hasn’t it happened?

Make sure to head over there and read the rest. Fascinating stuff.

No comments:

Post a Comment